LedgerWay

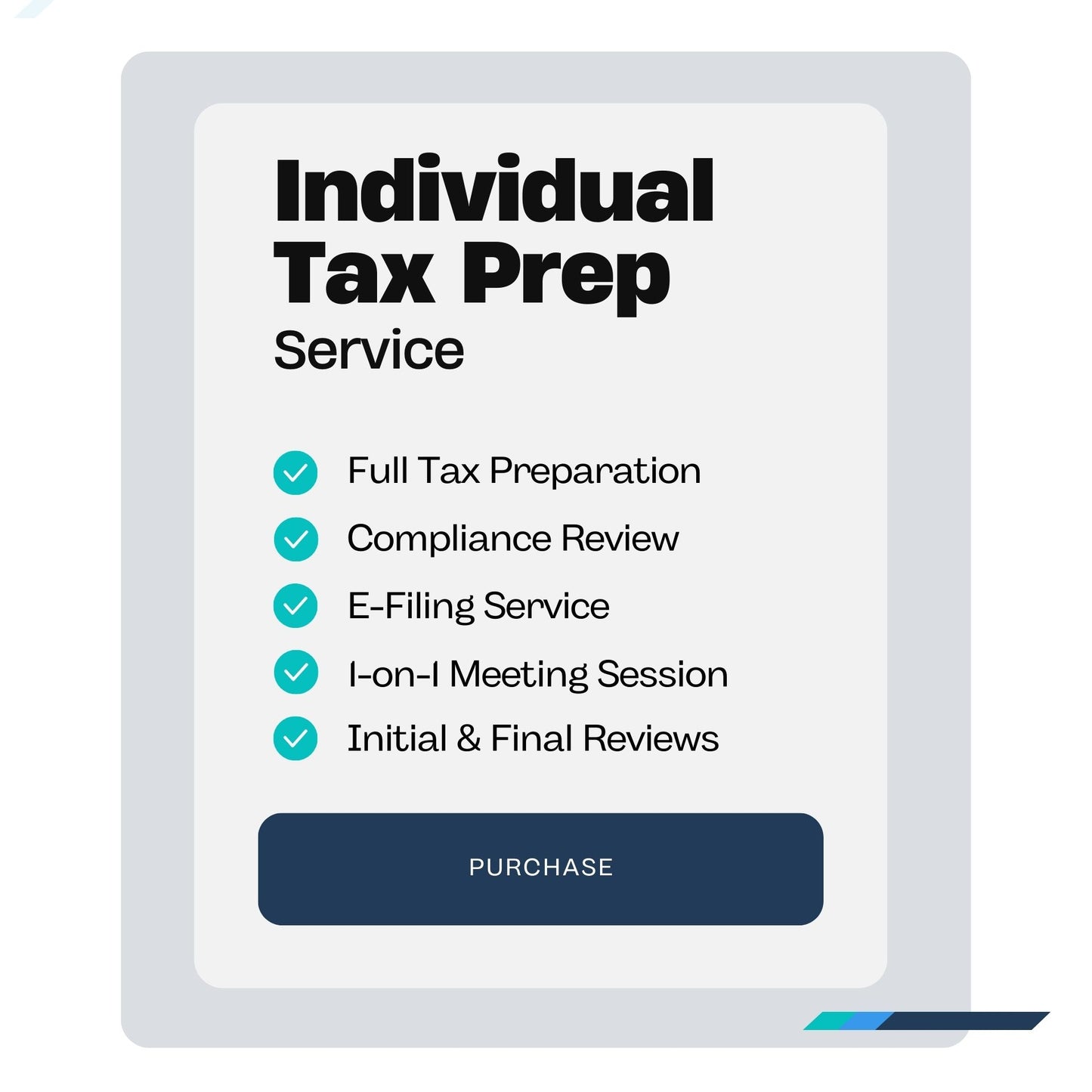

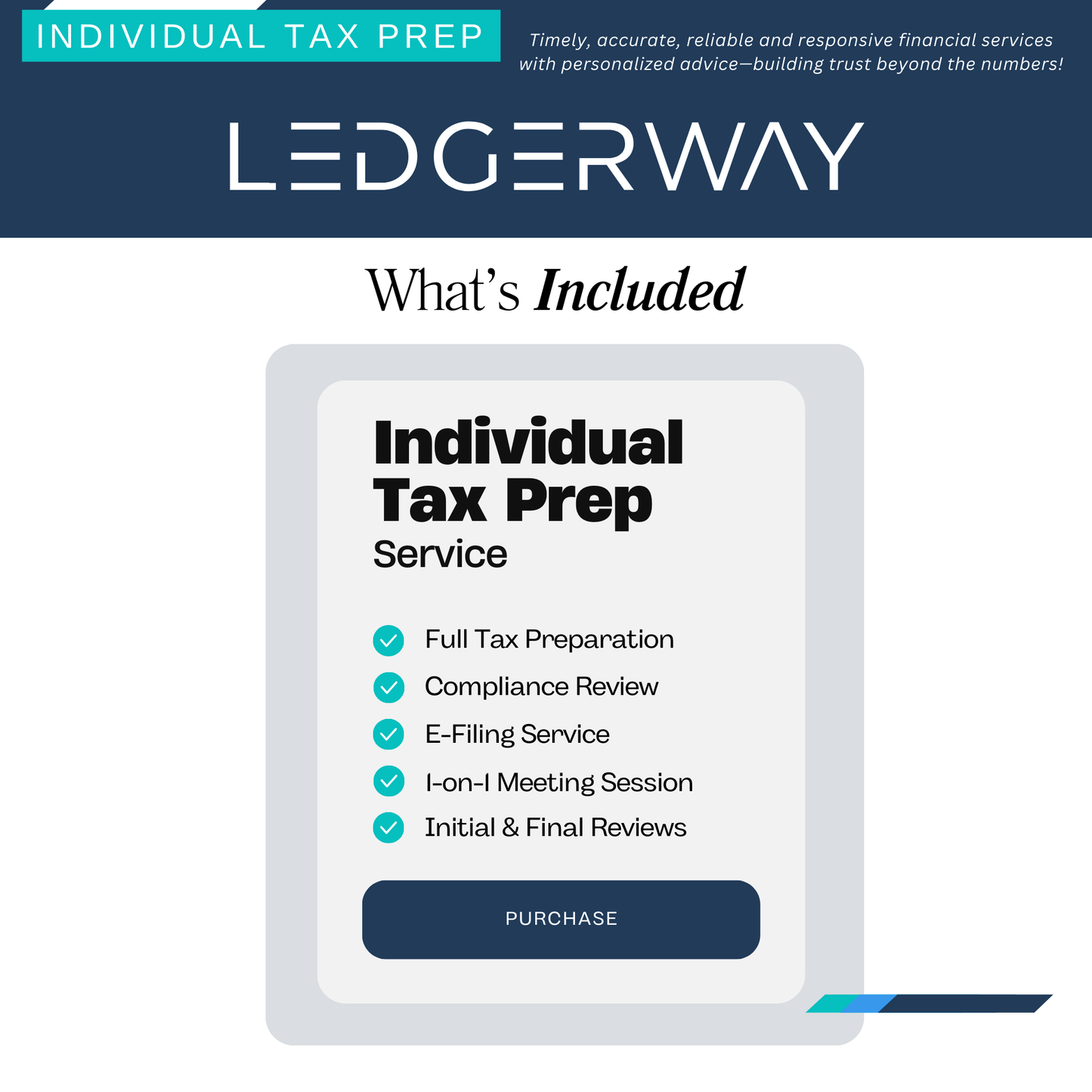

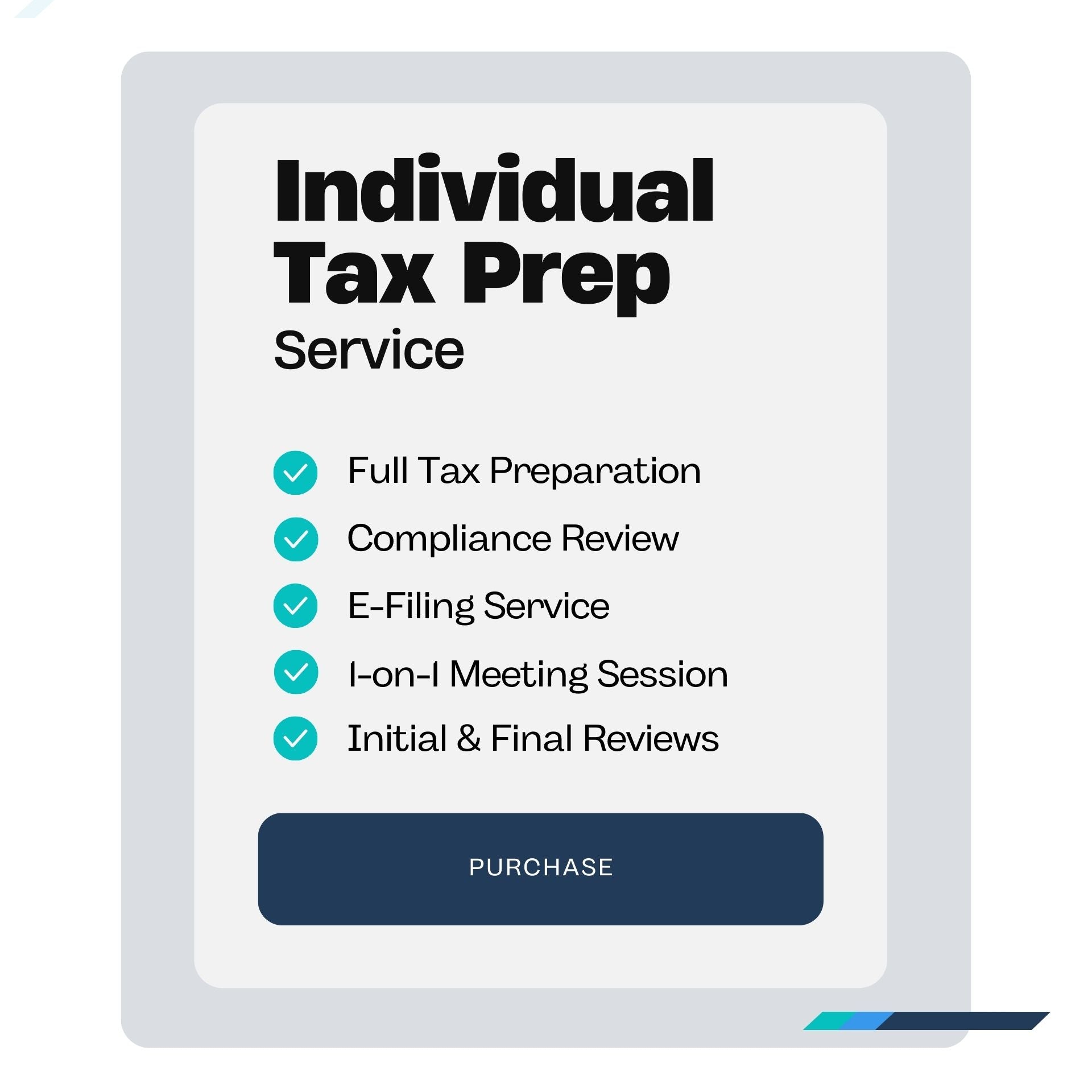

Individual Tax Return Preparation

Individual Tax Return Preparation

Overwhelmed by Tax Season? We Can Fix That

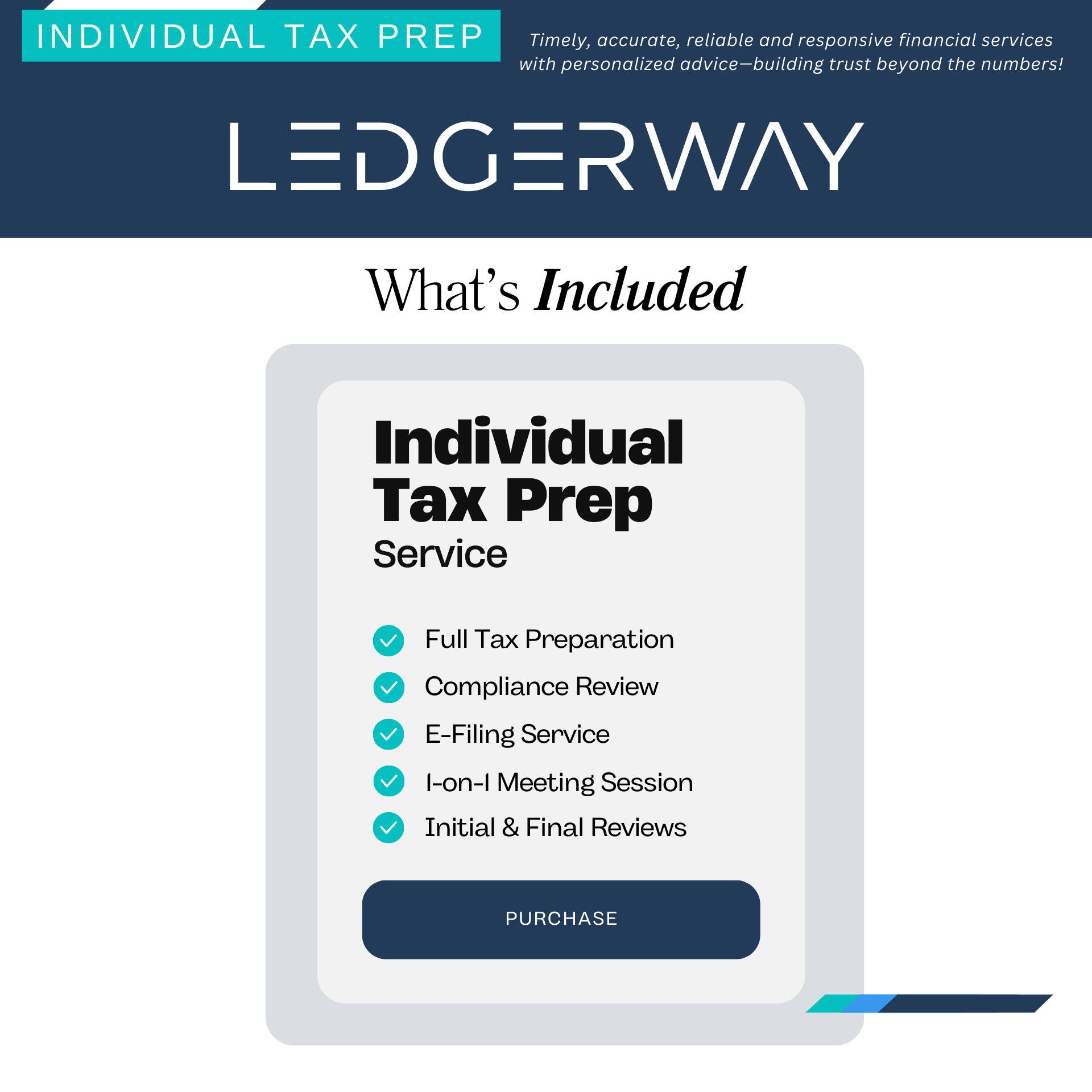

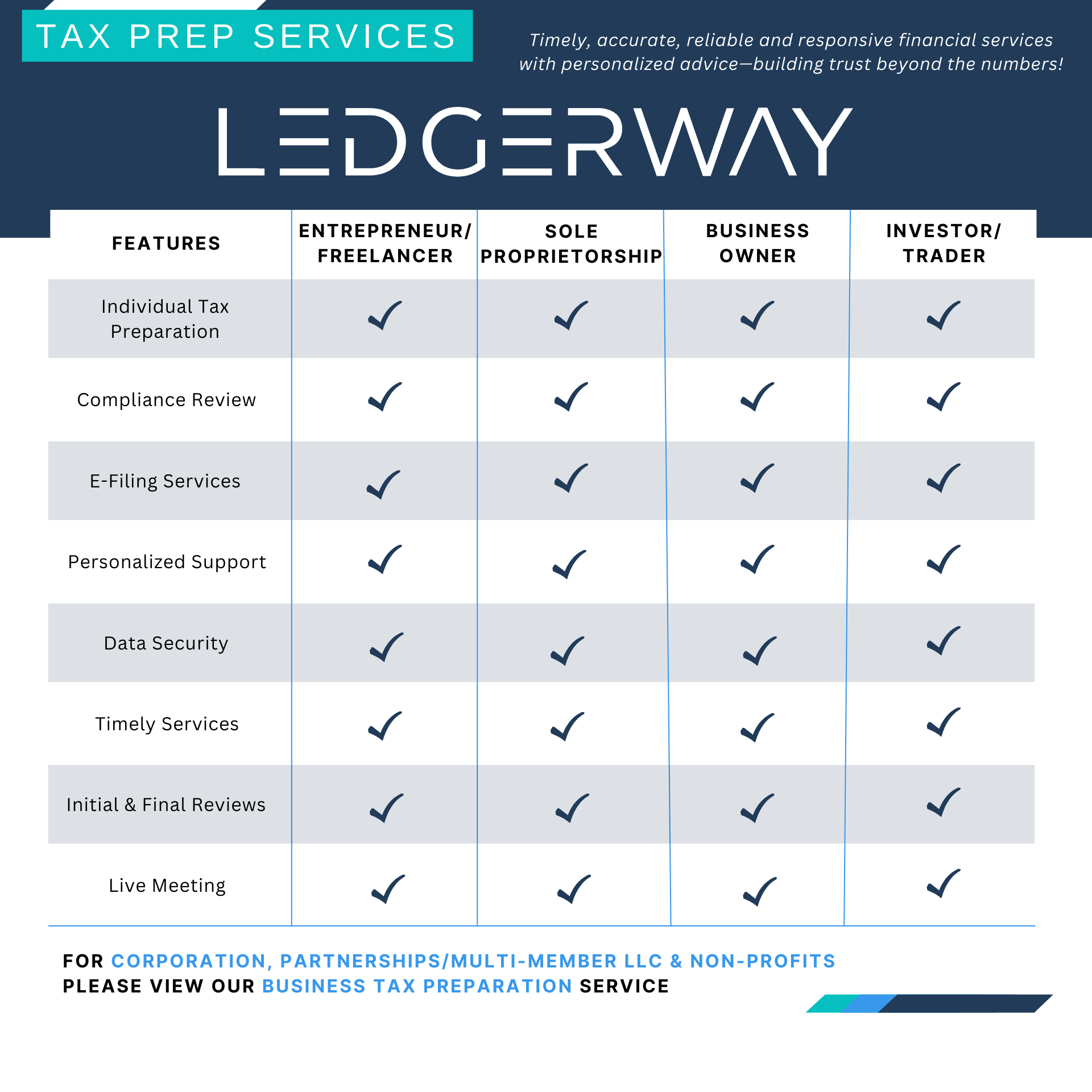

Our Individual Tax Return Preparation service isn’t just about filing taxes—it’s about making sure your personal finances, sole proprietorship or single-member LLC work for you, not against you at tax time.

Whether you're self-employed, a business owner, or just need an expert touch on your individual return, we’ve got you covered.

We know every situation is unique, and we’re here to handle it all:

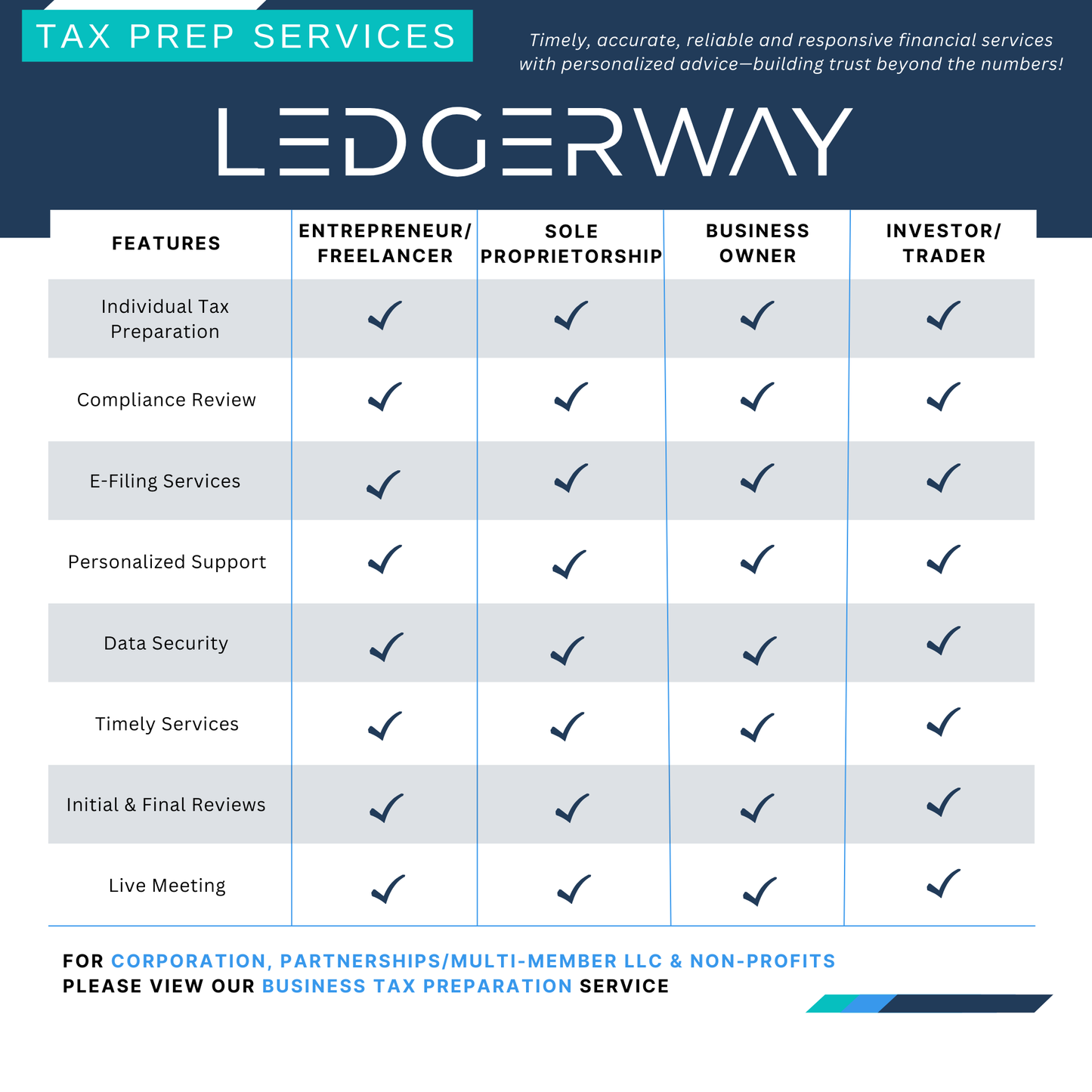

Entrepreneurs & Freelancers – Sole proprietors, gig workers, and self-employed professionals

Investors & Traders – Stock, crypto, and real estate investors navigating complex tax rules

Small Business Owners – Brick-and-mortar shops, e-commerce, and service-based businesses

Creative Professionals – Artists, content creators, influencers, and consultants

Individuals & Families – W-2 employees, homeowners, and anyone needing expert tax filing

Are You a Business Owner? We’ve Got You Covered

Filing your taxes shouldn’t be stressful—whether you’re managing personal finances, a sole proprietorship, or a single-member LLC. We help:

Accurately Report Income & Deductions – Ensure all eligible expenses are claimed for maximum savings

Optimize Tax Strategies – Find opportunities to lower your tax bill and keep more of what you earn

Handle Self-Employment & Business Income – Navigate tax requirements for sole proprietors and LLCs.

Ensure Compliance – Avoid errors that could lead to penalties, audits, or missed deductions.

Bigger refunds. Less stress. More money in your pocket. Let’s make tax season work for you!

Active Traders? We’ve Got You Covered

If you’re trading stocks, crypto or other assets throughout the year, tax reporting can get complicated fast. We help:

Track Gains & Losses – Properly report your capital gains and avoid IRS red flags.

Optimize Tax Strategies – Identify deductions and tax-efficient trading methods.

Handle Crypto Transactions – Navigate complex reporting requirements for digital assets.

Ensure Compliance – Avoid mistakes that could lead to penalties or audits.

Maximize deductions. Minimize stress. Keep more of what you earn. Let’s get your taxes done right!

We are

✅ Timely

✅ Accurate

✅ Reliable

✅ Responsive

Why Choose Us?

Dependable solutions to optimize your tax strategy

Accurate, reliable filings that keep you compliant

Quick, responsive service—because your time matters

Skip the paperwork panic and focus on what really matters—your time and your business.

This service covers one state income. If multiple state tax returns are needed, please select a higher quantity number as needed before purchasing.

Couldn't load pickup availability

Share

If the financial statements are inaccurate or incomplete, you will need to either complete them yourself or hire us to make the necessary corrections. If financial statements are inaccurate, we reserve the right to hold preparation until they have been corrected. You are welcome to sign up for our catch-up accounting services or engage us on hourly basis during your on-boarding call. If the wrong selection of service was made, we reserve the right to change the service to the correct option. Please note, tax planning and strategy are not included in this service.

View full details